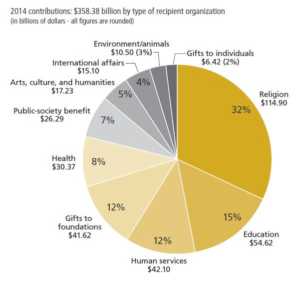

According to charitynavigator.org, nearly $360 BILLION was given to charities last year by American consumers and businesses. The amount of charitable giving has increased steadily over the past five years.

When completing your monthly budget, determining how much money you should give to charitable causes, organizations, or places of worship can be tricky. It’s important to remember than you shouldn’t give more than you can afford to. You should always be able to pay your bills and cover other expenses without the use of cards along with putting money towards saving and retirement before you set any charitable funds aside.

The actual amount that you choose to give to a charity depends on a number of factors, and it’s not solely dependent on your income. In fact, households with a smaller combined income actually give a larger percentage of their income to charity than households who earn a larger wage.

Again, the most important thing to remember that you shouldn’t give more than you can afford to. Although we may want to be generous in our gift giving, charitable contributions should be viewed as any other monthly expense. Make sure that you budget for it and build it into your savings plan.