One of our most requested products from business owners is a line of credit. A line of credit is a great way to access short-term funds needed to operate your business, but for a lot of business owners- there might be a better way!

Crane Credit Union’s Business Visa is an excellent product that allows convenient access to funds up to $50,000. There are no origination costs, no collateral requirements, and no cash advance fees. The interest rate on the Crane Credit Union Business Visa is also very reasonable especially compared to other rates you might find on credit cards from other institutions. You can also have cards made for your employees which allows you to limit the credit availability and monitor purchases per card.

Examples of businesses who might benefit from a Business Visa:

- A small or new business that needs a loan to finance inventory.

- A business who has employees that make purchases on behalf of the business.

- A business who needs access to funds to finance accounts receivables under $50,000.

- Plus many more!

Crane Credit Union’s Business Line of Credit is also a great product that is geared towards established businesses who need short-term financing for larger amounts. The line of credit allows you to access the funds you need now to operate your business. Make monthly interest payments on the amount you draw and pay the line down when you get paid for your hard work.

Examples of businesses who might benefit from a Business Line of Credit:

- Farmers who need operating lines of credit to finance crop inputs or livestock purchases.

- Real estate investors who need fast access to funds to make cash offers or funds for auctions.

- Seasonal businesses who need short term financing during their closed or slow season.

- Plus many more!

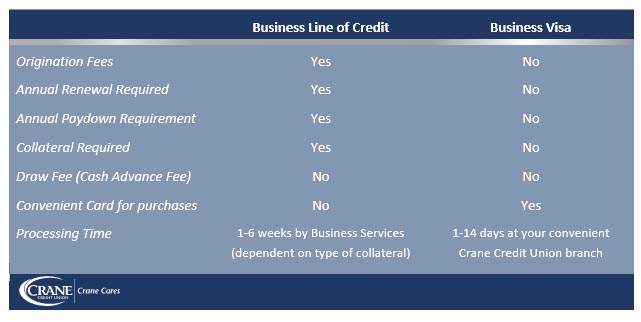

For businesses that need access to funds over $50,000 the Business Line of Credit is a great product, but for a lot of businesses, the Business Visa is a less expensive and more convenient product. See the comparison chart below.

Think a Crane Credit Union Business Visa or Line of Credit could help your business grow? Stop into one of our branch locations or email our Business Services Department at business@cranecu.org.

About the Author: Beth Mason is the Manager/Credit Risk Officer for the Business Services Department at Crane Credit Union. She has 15+ years of experience in the financial services industry and has a passion for helping business owners find financial products and services that allow them to efficiently run and grow their businesses. You can contact Beth by emailing her at bmason@cranecu.org or by calling 812-863-7148.